Pocket Option Donchian Channels: Unlocking the Power of Trend Following

The financial market can be a daunting place, especially for newcomers. However, by utilizing efficient trading strategies and tools, traders can navigate this environment with greater confidence. One such powerful tool available on platforms like Pocket Option is the Donchian Channels indicator. Pocket Option Donchian Channels https://trading-pocketoption.com/trendovyj-indikator-donchian-channels/ This article will explore what Donchian Channels are, their application, benefits, and how to leverage them when trading on Pocket Option.

What are Donchian Channels?

Donchian Channels were developed by Richard Donchian, a pioneer in technical analysis. The indicator consists of three lines: the upper band, the lower band, and the middle line (basis). The upper band represents the highest price over a specified period, while the lower band indicates the lowest price during that same timeframe. The middle line is usually the average of the upper and lower bands. Typically, traders use a standard period of 20 days to calculate these values, although adjustments can be made depending on specific strategies.

Understanding the Components of Donchian Channels

To effectively utilize the Donchian Channels, it’s essential to understand its components:

- Upper Band: The highest price over the set period, indicating potential resistance levels.

- Lower Band: The lowest price over the set period, showing potential support levels.

- Middle Band: This serves as a moving average and gives traders a clearer view of the price trend.

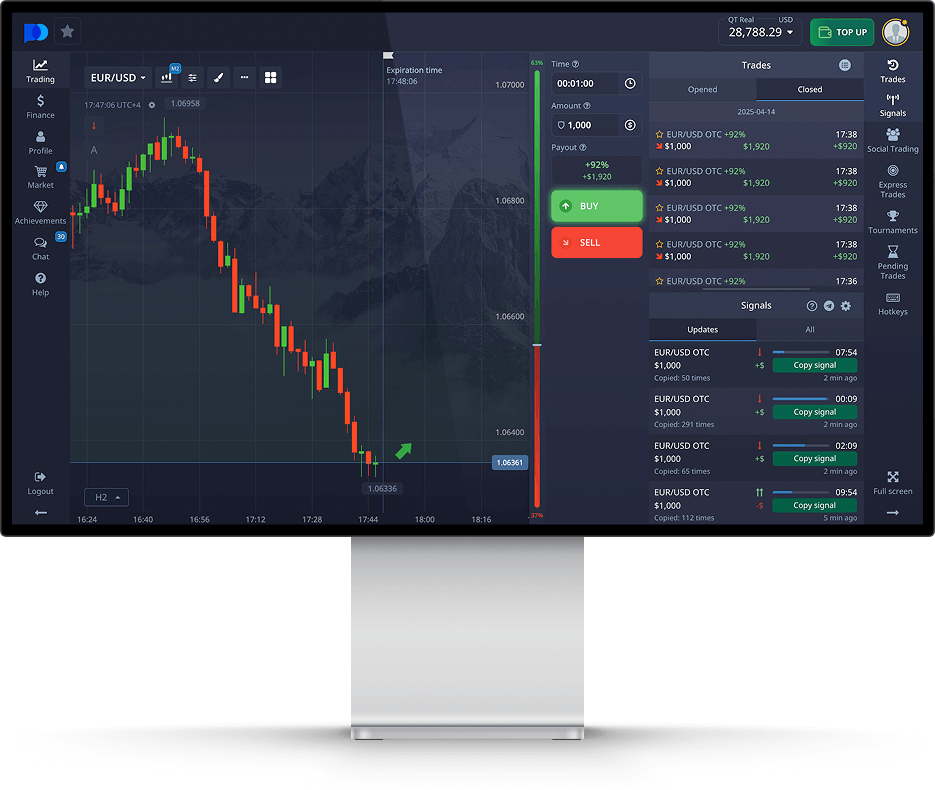

Setting Up Donchian Channels on Pocket Option

Setting up the Donchian Channels on Pocket Option is straightforward. Here’s how you can add this indicator to your trading chart:

- Log into your Pocket Option trading account.

- Navigate to the chart area of the asset you wish to trade.

- Locate the indicators section and search for “Donchian Channels.”

- Select the indicator and adjust the parameters according to your trading strategy—20 periods are commonly used.

How to Trade Using Donchian Channels

Donchian Channels are primarily used for determining market trends. Here are a few strategies traders employ:

1. Trend Following Strategy

The main use of Donchian Channels is to follow trends. If the price breaks above the upper band, it’s considered a buy signal, indicating a potential bullish trend. Conversely, if it breaks below the lower band, it’s interpreted as a bearish signal, suggesting a potential selling opportunity.

2. Breakout Trading

In breakout trading, traders look for price movements beyond the established channels. When the price closes outside the upper or lower bands, it signals a potential breakout worth trading.

3. Reversal Trading

Some traders use Donchian Channels to identify potential reversals. If the price approaches the upper band after a strong uptrend, it might be overbought, and vice versa. This method requires extra indicators or price action analysis to confirm entry points and avoid false signals.

Advantages of Using Donchian Channels

Donchian Channels offer several benefits for traders. Key advantages include:

- Simplicity: The visual representation makes it easy to understand market trends and price movements.

- Versatility: The indicator can be adapted to various trading styles, including day trading, swing trading, and long-term investing.

- Clear Signals: The breakouts generated by Donchian Channels tend to provide clear entry and exit points, helping simplify trading decisions.

Limitations of Donchian Channels

While Donchian Channels are a powerful tool, they do have limitations:

- Lagging Indicator: As a trend-following indicator, it may lag behind price movements, causing delays in decision-making.

- False Signals: During a ranging market, Donchian Channels can produce multiple false signals, which may lead to losses if not managed correctly.

Best Practices for Trading with Donchian Channels

To maximize the effectiveness of the Donchian Channels indicator, consider these best practices:

- Combine with Other Indicators: Use Donchian Channels alongside other indicators, such as moving averages or RSI, to validate signals and reduce the chance of false entries.

- Set Stop Loss and Take Profit Levels: Always implement risk management techniques, including stop loss and take profit orders, to protect your capital.

- Stay Informed: Keep abreast of market news and global events that can impact price movements and influence trading decisions.

Conclusion

Donchian Channels are a valuable addition to any trader’s toolkit, especially on platforms like Pocket Option. By understanding how to implement and interpret this indicator, traders can improve their decision-making and potentially enhance their trading performance. By using proper risk management and combining Donchian Channels with other indicators, you can develop a comprehensive trading strategy suited to your style and objectives.